Beachbody Raises $5.3M Via Registered Direct Offering

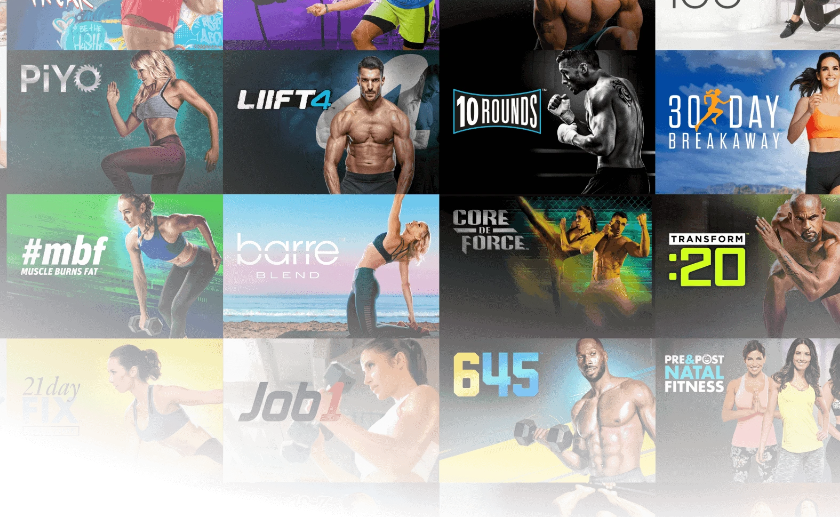

It’s the latest money move from the California-based subscription health and wellness company, which recently rebranded to BODi

The Beachbody Company, the subscription health and wellness company now doing business as BODi, has entered into a definitive securities purchase agreement with institutional investors for the purchase and sale of 543,590 shares at a purchase price of $9.75 per share in a registered direct offering.

The California-based health and wellness company says the closing of its offering is expected to occur on or about December 13, 2023. The offering is expected to generate approximately $5.3 million in gross proceeds to BODi, before placement agent’s fees and other offering expenses. BODi says it will use the net proceeds for general corporate purposes.

BODi will also issue to the investors warrants to purchase up to 543,590 shares of common stock, with an exercise price of $11.24 per share, which will be exercisable six months following the date of issuance and have a term of five and one-half years following the date of issuance.

The health and wellness platform has been in the midst of an ongoing strategy to restore the brand to its former glory, but it has proven to be a rocky road. The registered direct offering follows a reverse stock split the BeachBody Company instituted last month.

“We are confident that our recently developed turnaround plan will help drive profitability, free cash flow and help to increase our cash on the balance sheet,” said Mark Goldston, executive chairman, of last month’s reverse stock split completion. “In addition to the major cost savings program we have implemented, we are aggressively developing new programs to unlock incremental revenue opportunities.”

Goldston added that BODi’s execution of its “robust turnaround plan” will put the company on the right path to regain compliance with the New York Stock Exchange’s minimum closing price requirements and “drive long-term shareholder value.”

BODi posted its Q3 2023 results in November, showing a total revenue decline — $128.3 million compared to $166.0 million in the prior year period. Carl Daikeler, BODi’s co-founder and CEO, noted that for the remainder of the year, the company would be “intensely focused” on executing its sales and marketing initiatives.

Earlier this year, the company rebranded from The Beachbody Company to BODi. Around that same time, the company was hit with a class-action suit brought forth by a former Beachbody coach targeting its multi-level marketing structure. (The company denies the allegations and, in a statement to Athletech News, said it would “vigorously defend” itself against the suit.)

Most recently, BODi established a new effort to reward its high-performing network sales partners with special bonuses, which will begin in January 2024.

The company also named author, speaker and high-performance coach Brendon Burchard its chief growth and performance Advisor.

Courtney Rehfeldt has worked in the broadcasting media industry since 2007 and has freelanced since 2012. Her work has been featured in Age of Awareness, Times Beacon Record, The New York Times, and she has an upcoming piece in Slate. She studied yoga & meditation under Beryl Bender Birch at The Hard & The Soft Yoga Institute. She enjoys hiking, being outdoors, and is an avid reader. Courtney has a BA in Media & Communications studies.